Leading Considerations to Bear In Mind for Your Offshore Service Formation Journey

When considering the establishment of an overseas service, a careful choice of territory is critical. Navigating this surface requires a keen understanding of diverse lawful landscapes and an adeptness at straightening organization goals with local benefits.

Picking the Ideal Territory for Your Service

Choosing the optimum jurisdiction for your service is a crucial choice influenced by numerous legal, tax obligation, and functional considerations. Entrepreneurs must assess the tax obligation routine of a prospective territory, as it can greatly impact the total profitability and efficiency of a procedure. Jurisdictions with low or no business taxes are commonly appealing, yet it's essential to assess any double taxes treaties that might exist with other countries to stay clear of unpredicted tax obligation commitments.

In addition, the political security of a jurisdiction is vital. A steady political setting makes certain a reduced risk of abrupt governing modifications that could negatively impact business. The economic atmosphere ought to support organization development, characterized by strong facilities, convenience of accessibility to markets, and an experienced labor force.

Finally, the track record of the jurisdiction need to not be ignored. Developing an organization in a region understood for transparency and great governance enhances integrity with global companions and customers.

Abiding and recognizing With Neighborhood Lawful Requirements

Business owners ought to engage neighborhood legal professionals or specialists who specialize in offshore service setups. These experts can provide vital insights into required legal procedures, making sure that business follows all regional policies from the beginning. This action not only aids in preventing legal issues yet additionally in developing a robust structure for the company.

Furthermore, understanding the legal effects of intellectual home civil liberties, data security laws, and conformity requirements connected to ecological laws is critical. These elements can influence company operations and dictate the strategic preparation and structuring of the firm within the chosen jurisdiction.

Evaluating Tax Frameworks and Motivations

Why should business owners pay close attention to tax obligation frameworks and incentives when developing an offshore organization? Entrepreneurs have to check that review how these tax regimens straighten with their business goals.

In addition, recognizing the possible tax obligation rewards, such as credit histories for study and advancement, can use extra economic advantages. It's vital to evaluate not just the present tax obligation benefits but likewise the security and durability of these incentives. Political and financial changes can change tax obligation policies, possibly impacting business detrimentally. For that reason, extensive research and potentially seeking advice from tax obligation professionals or lawful advisors in the selected territory can provide important insights, making sure that the tax structure selected sustains lasting business growth and conformity.

Developing a Strong Financial and Monetary Infrastructure

Developing a strong financial and economic framework is vital for the success of any kind of offshore service. This framework functions as the foundation for taking care of resources flows, taking care of forex, and sustaining financial purchases vital to daily operations (Offshore Business Formation). Picking the best banking companion in a secure territory can provide many advantages including boosted safety and security, desirable financial policies, and access to specialized economic services customized for international business

Companies have to consider factors such as the political stability of the host nation, the online reputation of its financial field, and the availability of multi-currency accounts. Integrating innovative financial innovation can streamline processes, lower costs, and boost deal rate, hence strengthening the business's financial structure in a competitive global market.

Managing Threats and Shielding Possessions in an International Setting

Additionally, geopolitical threats necessitate the implementation of extensive threat analysis strategies. Firms should regularly assess political security, governing modifications, and prospective monetary policies that can impact procedures. This aggressive method assists in alleviating unanticipated interruptions.

Possession defense strategies in offshore atmospheres likewise consist of branching out financial investments and keeping confidentiality with discrete business structures. Making discover this info here use of numerous jurisdictions can spread threat and offer fiscal advantages, while maintaining operational discretion secures competitive advantages and corporate possessions from unrequested analysis or aggressive atmospheres. These steps are critical in protecting a business's long life and success in the global market.

Conclusion

In final thought, developing an offshore company requires cautious consideration of several critical facets. Choosing a jurisdiction with beneficial tax obligation plans and political security, comprehending local lawful needs, and examining tax motivations are critical.

Picking the optimal jurisdiction for your service is a vital choice influenced by various legal, tax, and operational factors to consider.Why should business owners pay close focus to tax obligation structures and incentives when forming an offshore business? Entrepreneurs must assess how these tax regimens straighten with their company goals. Political and financial modifications can change tax plans, potentially impacting the service negatively (Offshore Business Formation). Comprehensive study and potentially seeking advice from with tax obligation experts or lawful advisors in the chosen territory can provide very useful insights, guaranteeing that the tax obligation structure selected sustains lasting organization growth and conformity

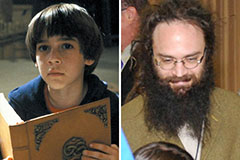

Barret Oliver Then & Now!

Barret Oliver Then & Now! Anthony Michael Hall Then & Now!

Anthony Michael Hall Then & Now! Justine Bateman Then & Now!

Justine Bateman Then & Now! Dolly Parton Then & Now!

Dolly Parton Then & Now! Nicki Minaj Then & Now!

Nicki Minaj Then & Now!